Running a business can be incredibly rewarding, but it can also be incredibly stressful. As a business owner, you have to juggle countless responsibilities, from managing employees to keeping track of finances. It's no wonder that many business owners find themselves feeling overwhelmed and stressed out. One of the biggest sources of stress for business owners is cash flow. If your business relies on timely receivables, an extended collection period can critically affect your bottom line. That's where IBS comes in. By extending credit terms to your customers and outsourcing your accounts receivable process to IBS, you can improve your cash flow and reduce your stress levels.

The Stressed Business Owner: How IBS A/R Can Help Improve Cash Flow

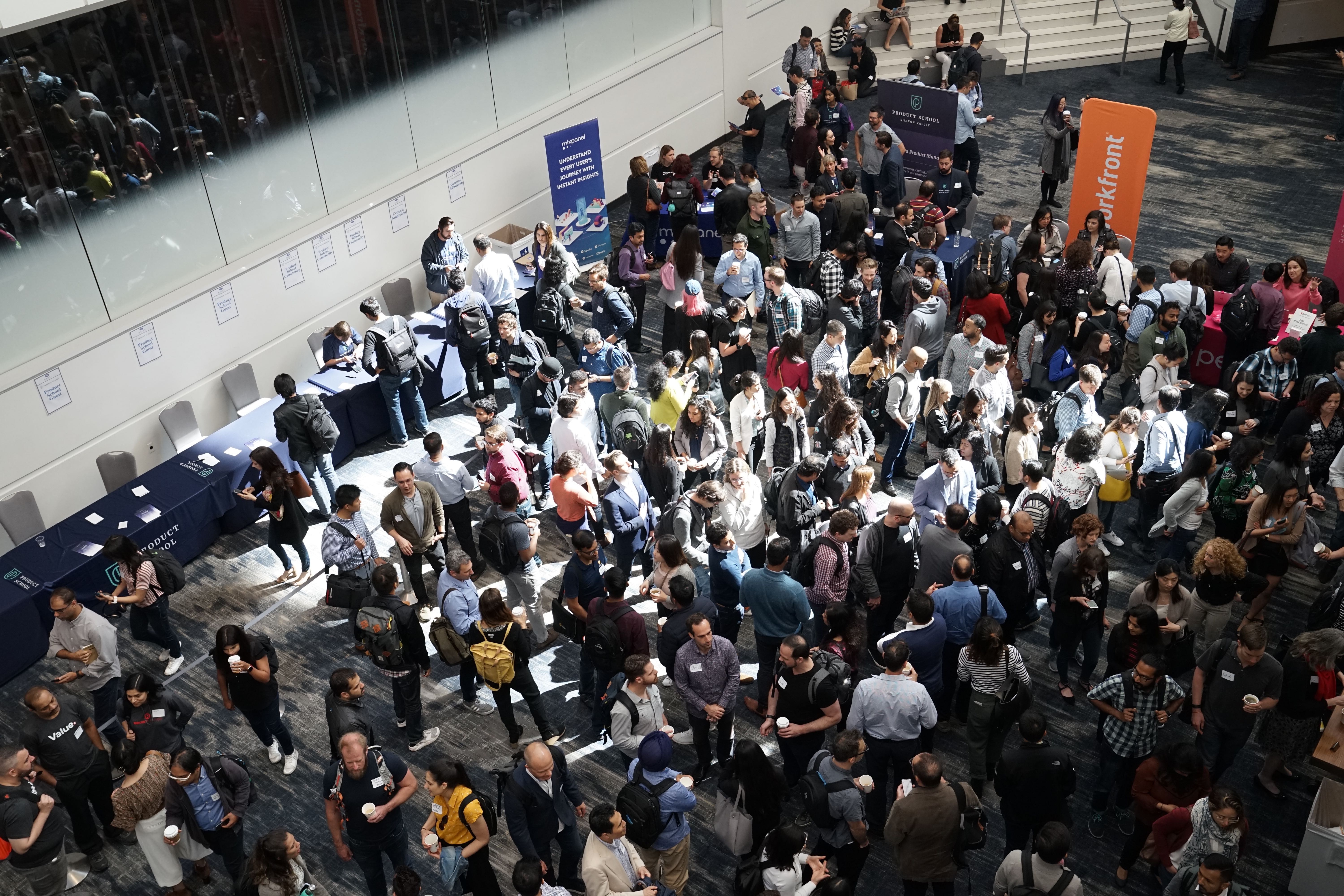

The Ultimate Guide to Trade Show Representation

Introduction

You're considering exhibiting at your next trade show. That's great! But before you sign up, there are a few things you need to know about trade show representation.

Embrace Efficiency - Reasons to Outsource Accounts Receivable

Introduction

You may have heard the old saying, "time is money." And in the world of business, that's certainly true. The more efficiently you can run your operations, the more money you'll make.

Used Truck Sales See Slight Slip, but Market Optimism Remains

You may have heard that the used truck market is slowing down. While this is true, there are still plenty of good deals to be had.

The Hidden Costs of Running a Truck Parts Business

You're probably familiar with some of the common costs of running a truck parts business, such as inventory and labor. But some hidden costs can add up if you're not careful.

Make your accounts Receivable Process Easy and Painless

Receiving payments from customers is an important part of any business. But it can also be a hassle. Trying to keep track of who owes you money, chasing down payments, and dealing with late payments can all be time-consuming and frustrating. We'll walk you through the best ways to get paid quickly and easily.

How To Build an All-Star Accounts Receivable Team

The strength of your accounts receivable team depends on the strengths of the individual team members. Ideally a company would be able to hire multiple employees to handle the different areas of accounts receivable: billing, credit, and collections. But the reality is that many companies only have the bandwidth to hire one or two general A/R specialists.

How Heavy-Duty Aftermarket Companies Can Attract Fleet Customers

In the past decade alone, technology has changed the heavy duty aftermarket industry landscape. With big-box companies like Amazon getting into the game, small to midsize businesses need to do everything they can to compete and attract new fleet business, while still maintaining their existing customers.

How to Manage Slow Periods in Accounts Receivable

Just as any business has its slow and busy seasons, seasonality can also affect accounts receivable -- in workflow and cash flow. The best way to be ready for the highs and lows is to forecast properly and take action to help business ride out the dips and valleys. Rather than be caught unaware of possible payment lags, the best policy is to stay informed and proactive.

How to Build Strong Vendor Relationships

Developing strong vendor relationships is crucial to the health of your business and can have a big impact on its success. Vendors benefit businesses in many ways by providing knowledge and expertise, and by supplementing your business offerings. Partnering with vendors to fill in the gaps in the supply chain keeps costs down and business processes running more efficiently. This can be invaluable in the face of disruptions. Vendors also help companies remain on the cutting edge and improve overall quality. As such, it’s important to build and maintain strong vendor relationships.