At Interstate Billing Service, we take the security of our clients and customers seriously. Fraud prevention is an industry-wide concern impacting businesses around the world. Here are a few tips and tricks to help you avoid fraud.

The Stressed Business Owner: How IBS A/R Can Help Improve Cash Flow

Running a business can be incredibly rewarding, but it can also be incredibly stressful. As a business owner, you have to juggle countless responsibilities, from managing employees to keeping track of finances. It's no wonder that many business owners find themselves feeling overwhelmed and stressed out. One of the biggest sources of stress for business owners is cash flow. If your business relies on timely receivables, an extended collection period can critically affect your bottom line. That's where IBS comes in. By extending credit terms to your customers and outsourcing your accounts receivable process to IBS, you can improve your cash flow and reduce your stress levels.

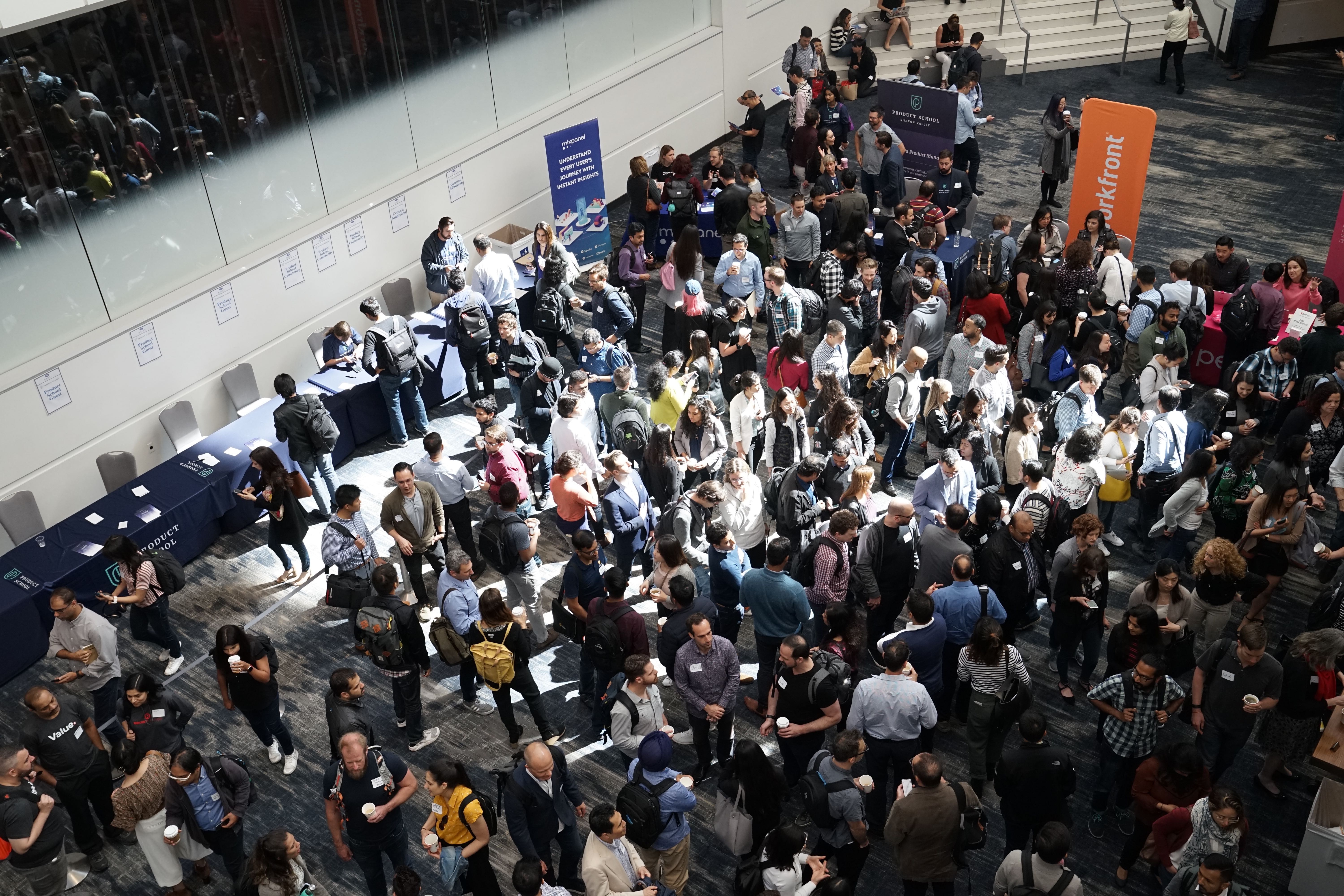

The Ultimate Guide to Trade Show Representation

Introduction

You're considering exhibiting at your next trade show. That's great! But before you sign up, there are a few things you need to know about trade show representation.

Embrace Efficiency - Reasons to Outsource Accounts Receivable

Introduction

You may have heard the old saying, "time is money." And in the world of business, that's certainly true. The more efficiently you can run your operations, the more money you'll make.

The Relationship Between Credit/Collections and Sales

Introduction

Credit and collections are two important aspects of any business. When done correctly, they can help boost sales and grow the company. But when they're not handled properly, they can have a detrimental effect on the bottom line.

In this article, we'll discuss the relationship between credit and collections and sales. We'll look at how credit affects buying decisions and how delinquent accounts can hurt your business. We'll also offer some tips for improving your credit and collections management.

Used Truck Sales See Slight Slip, but Market Optimism Remains

You may have heard that the used truck market is slowing down. While this is true, there are still plenty of good deals to be had.

The Hidden Costs of Running a Truck Parts Business

You're probably familiar with some of the common costs of running a truck parts business, such as inventory and labor. But some hidden costs can add up if you're not careful.

Best Accounts Receivable Practices to Get Paid on Time Every Time

When it comes to getting paid on time, every time, you need to have a solid accounts receivable (AR) system in place.

There are all sorts of ways to take back control and get paid on your terms. In this post, we'll share some of the best AR practices that will help you do just that.

So, whether you're just starting in business or you've been around for a while, read on for some tips that will help you get paid on time, every time.

How Accounts Receivable Automation Can Benefit Your Business

As a business owner, you know that managing your accounts receivable can be a time-consuming task. You also know that getting behind on your invoices can cause all sorts of problems, from cash-flow issues to bad credit scores.

How Service Managers Can Increase Invoiced Hours

Introduction

As a service manager, you're constantly looking for ways to increase the efficiency of your team and drive more invoiced hours. But what are the best tactics for accomplishing this?